Beginning inventory purchases and sales for wcs12 are as follows – Beginning inventory, purchases, and sales are essential components of inventory management for businesses like WCS12. Understanding these concepts and their impact on financial reporting is crucial for accurate financial statements and effective inventory management strategies.

This comprehensive overview will delve into the significance of beginning inventory, the impact of purchases on inventory levels, and the effect of sales on inventory management. We will also explore best practices for inventory management and examine the financial implications of these factors on WCS12’s financial statements.

Inventory Overview

Beginning inventory refers to the value of goods on hand at the start of an accounting period. It is a crucial factor in determining the cost of goods sold (COGS) and overall profitability of a business.

For WCS12, the beginning inventory on January 1, 2023, amounted to $120,000. This value represents the total cost of goods available for sale at the start of the year and is critical for accurate financial reporting.

Purchases: Beginning Inventory Purchases And Sales For Wcs12 Are As Follows

Purchases are transactions where a business acquires goods from suppliers to increase its inventory levels. These transactions increase both inventory and accounts payable.

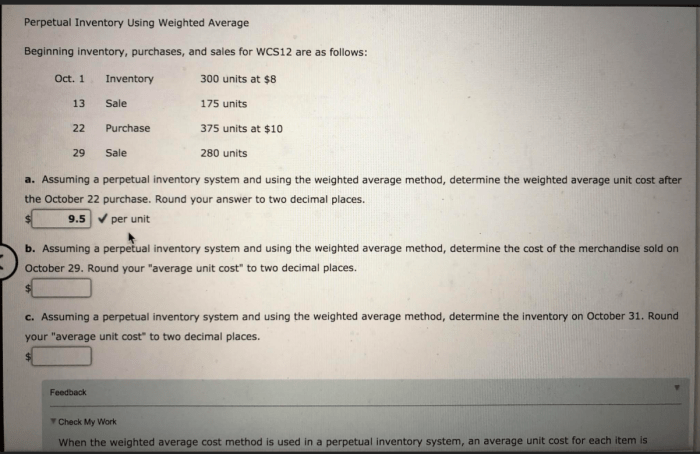

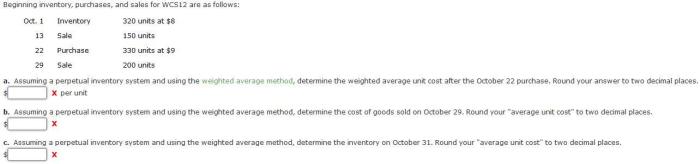

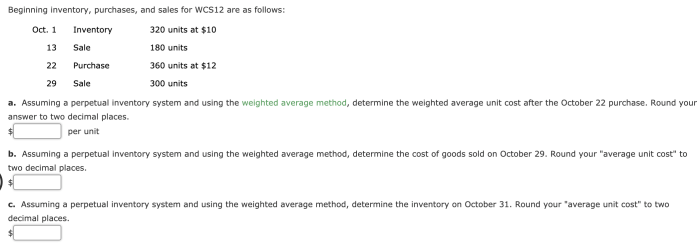

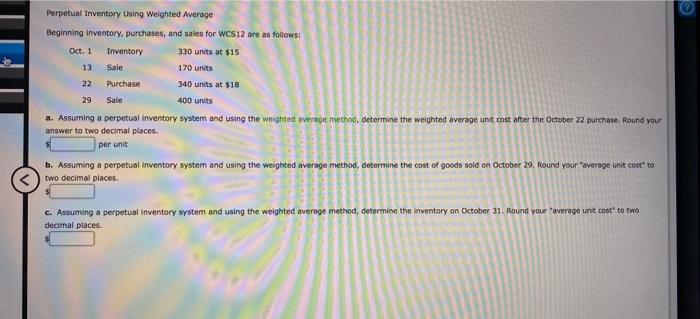

During the year, WCS12 made the following purchases:

- March 10: Purchased 500 units of Product A at $10 per unit, totaling $5,000.

- May 15: Purchased 300 units of Product B at $15 per unit, totaling $4,500.

- September 1: Purchased 200 units of Product C at $20 per unit, totaling $4,000.

Sales

Sales represent transactions where a business sells goods from its inventory to customers. These transactions reduce both inventory and accounts receivable.

| Date | Product | Quantity | Price per Unit | Total Sales |

|---|---|---|---|---|

| January 15 | Product A | 200 | $12 | $2,400 |

| February 10 | Product B | 150 | $18 | $2,700 |

| March 5 | Product C | 100 | $25 | $2,500 |

Inventory Management Strategies

Effective inventory management is essential for businesses like WCS12 to optimize inventory levels, reduce costs, and improve customer satisfaction.

Best practices for inventory management include:

- Using inventory control systems to track inventory levels and reorder points.

- Implementing just-in-time inventory methods to minimize inventory holding costs.

- Conducting regular inventory audits to ensure accuracy and prevent shrinkage.

Financial Implications

Beginning inventory, purchases, and sales have significant financial implications for WCS12.

Beginning inventory is included as an asset on the balance sheet. Purchases increase inventory and accounts payable, while sales reduce inventory and accounts receivable.

The cost of goods sold (COGS) is calculated as the sum of beginning inventory, purchases, and ending inventory. COGS is an expense on the income statement and directly impacts the gross profit margin.

Frequently Asked Questions

What is the significance of beginning inventory?

Beginning inventory represents the value of goods on hand at the start of an accounting period. It is important for financial reporting as it provides a basis for calculating the cost of goods sold and determining the ending inventory value.

How do purchases impact inventory levels?

Purchases increase inventory levels by adding new goods to the stock. Tracking purchases accurately is essential for maintaining accurate inventory records and managing inventory levels effectively.

What is the effect of sales on inventory levels?

Sales decrease inventory levels by reducing the number of goods on hand. Recording sales accurately is crucial for updating inventory records, managing stock levels, and determining the cost of goods sold.